Payroll Accounting in Switzerland: What Do Employers Need to Know?

Payroll accounting is one of the most important and legally sensitive areas of running a business in Switzerland. It requires strict adherence to Swiss labor law, social security regulations, and tax obligations. For startups and SMEs in particular, where resources are limited and compliance mistakes can be costly, getting payroll right is both a legal necessity and a foundation for employee trust.

In this comprehensive guide, we explain how Swiss payroll accounting works, what responsibilities employers carry, which deductions must be made, and how to issue a compliant payslip. We also offer proactive tips for avoiding common mistakes, improving your payroll efficiency, and deciding whether outsourcing is the right choice for your business.

Book a free initial consultation with our experts.

Book a callHighlights

- Payroll accounting is mandatory in Switzerland and clearly regulated by law for all employers

- Employers must register all employees correctly and prepare payroll statements

- AHV, ALV, BVG and other deductions are legally prescribed and must be calculated correctly

- Common mistakes made by SMEs include incorrect BVG rates or outdated employee data

- Outsourcing saves time, reduces error risks, and relieves internal resources

Content

- Payroll Accounting in Switzerland: What Do Employers Need to Know?

- Highlights & content

- What is payroll accounting and why is it important?

- How does payroll accounting work in practice?

- What are your legal obligations as an employer?

- What deductions must be made from employees’ wages?

- What details must be included on a Swiss payslip?

- Common payroll mistakes and how to avoid them

- Should SMEs outsource payroll accounting?

- How does software help SMEs handle their payroll accounting?

- Your digital trustee partner

- FAQ

- Trusted by over 150 companies

What is payroll accounting and why is it important?

Payroll accounting is a legally required function for all Swiss employers. It involves the systematic recording, calculation, and reporting of employees’ salaries and social security contributions. Moreover, proper payroll accounting is essential to ensure compliance with Swiss labor laws, accurate tax reporting, and maintaining employee trust.

Under Art. 323b para. 1 of the Swiss Code of Obligations (CO), every employee is entitled to receive a clearly understandable, written payslip each month. This document must show gross and net wages, all deductions, and applicable bonuses or allowances.

Efficient payroll processing and recording is of the highest importance for SMEs in Switzerland, as it ensures legal compliance and directly impacts cash flow planning, HR operations, and strategic decision-making.

Find out everything you need to know about our payroll accounting service.

Go to Payroll AccountingHow does payroll accounting work in practice?

Payroll accounting typically follows a monthly cycle and involves several key steps:

- Input of employee master data: This includes personal details, AHV number, role within the company, salary, etc.

- Wage calculation: Includes gross salary, bonuses, and additional allowances.

- Deductions: Includes basic social security (AHV/IV/EO), occupational pension (BGV), unemployment insurance (ALV), and optional components (e.g., daily sickness allowance insurance, withholding tax, etc.).

- Payslip generation: The above information should be included in the payslip which is issued in writing or digitally by the end of the month. Modern payroll software can help save time and resources by automating the generation of large numbers of payslips.

- Payments: Net wages are transferred to employees while contributions for social security, pension etc. are paid to the respective authorities and providers.

- Reporting: Monthly and annual declarations should be submitted to the compensation offices and pension funds.

It is generally acceptable to pay wages by the last day of each month, but employers and employees can agree on different wage payment dates contractually (Art 323 CO).

Book a free initial consultation with our experts.

Book a callWhat are your legal obligations as an employer?

Employers in Switzerland carry full responsibility for ensuring their payroll accounting is accurate, complete, and timely. This includes the following key obligations:

Issuing monthly payslips

Every employer is required under Swiss law to provide a written or digital payslip to their employees each month. This document must be clear and include all wage components, deductions, and bonuses. This is important for transparency with employees, as well as for maintaining proper documentation in case of audits or disputes.

Registering and deregistering employees

Upon hiring a new employee, the employer must register them with the appropriate social security and pension institutions. This includes registration for:

- AHV/IV/EO: Old-age, disability, and loss of earnings compensation

- ALV: Unemployment insurance

- BVG: Occupational pension fund (if income thresholds are met)

- UVG: Accident insurance (occupational and non-occupational)

- Family allowances (if applicable)

- Withholding tax: For foreign or cross-border employees

Deregistration is equally important when an employee leaves the company. All changes must be reported promptly to avoid penalties.

Tracking personnel master data

Employers must maintain accurate and up-to-date personnel master data for all employees. This includes:

- Full name and address

- Date of birth and nationality

- AHV number

- Marital status and number of children (for tax and allowance purposes)

- Bank account details and salary structure

A new payroll account must be opened when an employee joins, and all data must be updated if changes occur. This data forms the basis of all wage calculations and legal filings.

Managing deadlines for payments and declarations to social security institutions

Swiss law requires timely payment of both employee salaries and employer contributions to social security institutions. Deadlines vary depending on the insurance or authority involved, but failure to meet them can result in late fees or legal consequences. Employers must also submit monthly and annual wage declarations to compensation offices and pension providers.

Providing annual salary certificates to employees and tax authorities

According to the Federal Act on Direct Federal Taxation (DBG), employers must issue a written salary certificate (statement of income) to every employee at the end of each calendar year (Art. 127 para. 1 lit. a DBG). This document summarizes total income, deductions, and social contributions for the year and are necessary for personal income tax filing.

If an employer fails to issue the certificate or issues it incorrectly, they may be fined up to CHF 10,000 (Art. 174, para. 1, lit. b DBG) Employers must also submit these certificates to cantonal tax authorities as part of their reporting obligations.

Find out everything you need to know about our payroll accounting service.

Go to Payroll AccountingWhat deductions must be made from employees’ wages?

Switzerland has a clearly regulated deduction system consisting of mandatory social security contributions and other salary-related deductions. These are deducted directly from employees’ gross wages and transferred to the relevant social insurance and pension funds together with the employer’s share. The following information corresponds to the situation in 2025.

1st pillar: AHV/IV/EO and ALV

The first pillar of Switzerland’s social insurance system provides basic financial protection and is mandatory for all employees.

- AHV/IV/EO: Covers old age (AHV), disability (IV), and income compensation (EO) for temporary inability to work (e.g., military service, maternity/paternity leave, etc.). The total contribution is 10.6% of the gross wage, split equally between employer and employee (5.3% each).

- ALV: Unemployment insurance. Provides financial support in the event of job loss or reduced working hours. The standard contribution is 2.2% of gross wage, also split equally between employer and employee.

These contributions are deducted directly from the employee’s salary and paid monthly to the relevant compensation office. They form the foundation of social security coverage in Switzerland.

2nd pillar: occupational pension fund

Employers are required to register their employees with an occupational pension fund (BVG) once the annual salary exceeds a set threshold (CHF 22,680 as of 2025). Contribution amounts are based on age and insured salary.

The employer and employee share contributions equally, and the funds collected are invested and later used to finance retirement benefits, as well as risks such as disability and death.

Other deductions

Various other social security and tax deductions may apply, such as:

- Accident and occupational disease insurance (UVG) is mandatory for employees in Switzerland and covers medical costs and lost income due to workplace accidents or occupational diseases.

- Daily sickness allowance insurance provides financial protection for employees who are unable to work due to longer periods of illness.

- Family allowances are benefits provided to support families with children. These allowances help offset the costs of raising children and are funded entirely through contributions from employers.

- Withholding tax is a mandatory tax deduction for foreign employees who do not have a permanent residence permit or who live outside Switzerland. It is directly deducted from the gross salary by the employer and paid to the tax authorities. The rate depends on the employee’s income level, marital status, and place of residence.

- Church tax applies to employees who are registered members of a recognized religious community. It is deducted directly from the salary in cantons where church tax on income is levied and is based on the employee’s religious affiliation and place of residence.

These deductions must be accurately calculated by the employer and reflected on the monthly payslip.

Book a free initial consultation with our experts.

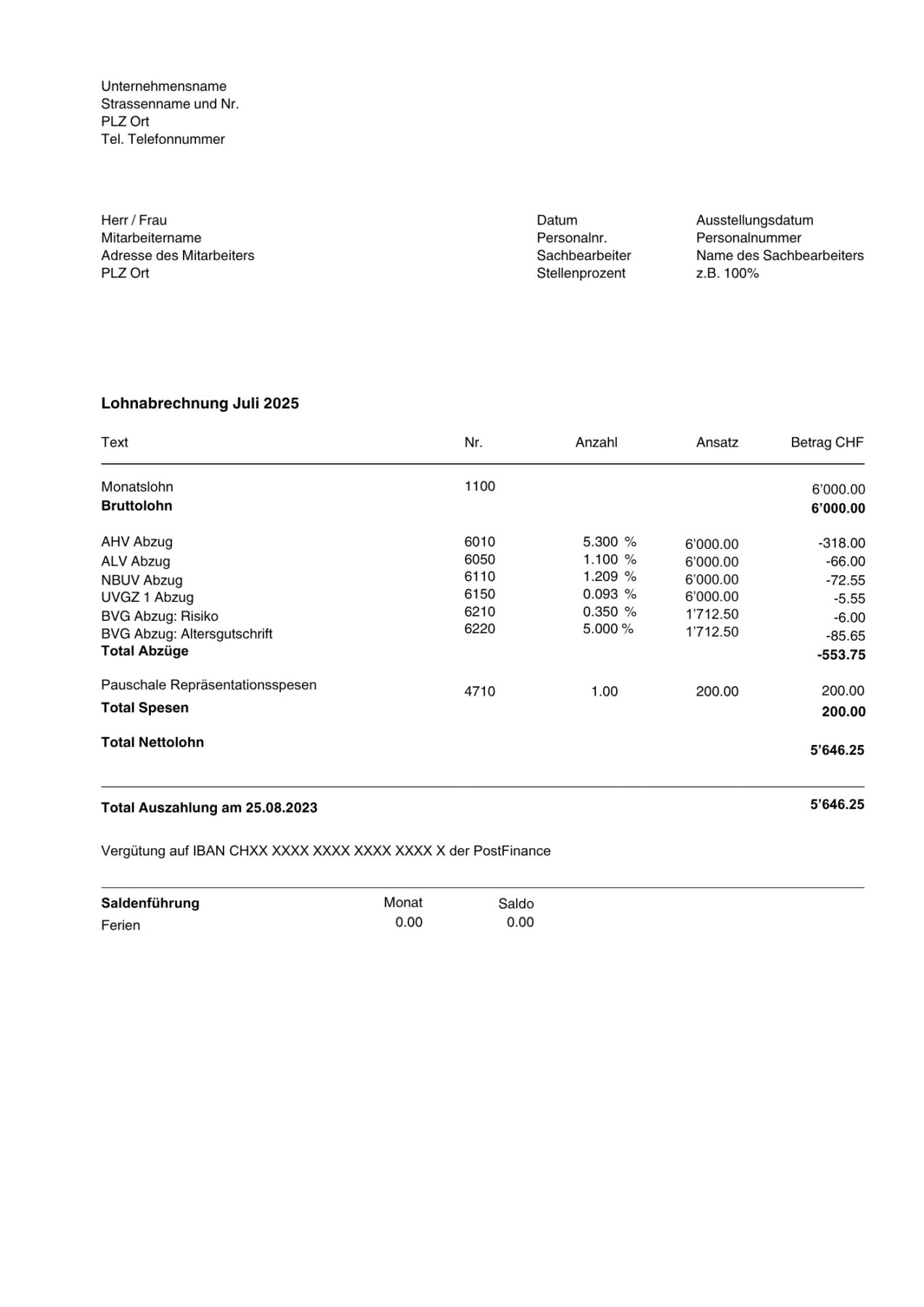

Book a callWhat details must be included on a Swiss payslip?

To comply with Swiss law, a payslip must include the following information:

- Name and address of employer and employee

- Payroll period covered

- Gross wage: base salary, bonuses, commissions, vacation pay

- Allowances and reimbursements: such as expense reimbursements (e.g. travel, meals, home office) and family allowances; these must be clearly itemized and distinguished from salary

- Mandatory deductions:

- AHV / IV / EO (old-age, disability, and loss-of-income insurance)

- ALV (unemployment insurance)

- BVG (pension fund contributions)

- Accident insurance: non-occupational (employee-paid) and occupational (employer-paid)

- Withholding tax (if applicable)

- Optional deductions: sickness benefits, church tax in applicable cantons

- Net wage

Note on income tax: In Switzerland, employers generally don’t directly deduct income tax from wages on behalf of employees. Swiss citizens and foreigners with a C permit file annual tax returns and pay income tax themselves. However, employees without a C permit (e.g. cross-border commuters or short-term foreign workers) are subject to withholding tax, which must be deducted directly from the gross wage by the employer and reported on the payslip.

Payslip example:

Here is a simple example of what a typical payslip may look like:

Find out everything you need to know about our payroll accounting service.

Go to Payroll AccountingCommon payroll mistakes and how to avoid them

Payroll accounting might seem relatively straightforward at first glance, but it involves many moving parts that must be carefully aligned to Swiss legal and regulatory standards. Even small oversights can create administrative headaches or lead to financial consequences.

Some of the most frequent mistakes include:

- Incorrect BVG thresholds or age-based contribution rates: Pension contributions vary depending on the employee’s age and salary, and it’s easy to apply the wrong rate or forget the coordination deduction.

- Outdated or incomplete employee master data: Details like address, marital status, AHV number, or number of children influence deductions and benefits. If these aren’t regularly updated, there may be errors in the payroll calculations.

- Missed registrations or deregistrations: Employers must notify social insurance providers and pension funds as soon as an employee joins or leaves. Delays can result in penalties or coverage gaps.

- Withholding tax errors: Misclassifying a foreign employee or applying the wrong cantonal rate can lead to underpayment or overpayment of taxes.

For SMEs in particular, it’s easy to make small errors. Unlike larger companies, they often don’t have a dedicated HR or accounting department. Mistakes can create legal risk, as well as damage employee trust when wages or payslips are incorrect.

So how can you avoid these pitfalls? The most effective approach is the right mix of:

- Reliable payroll software like SwissSalary, which automates most calculations and ensures regulatory compliance

- Clear internal processes for gathering and updating employee data

- Partnering with a fiduciary who understands the Swiss legal landscape and can competently handle your company’s payroll without errors or inefficiencies.

Nexova takes care of your payroll with precision, so you can focus on running your business without the unnecessary stress of compliance.

Book a free initial consultation with our experts.

Book a callShould SMEs outsource payroll accounting?

Outsourcing payroll means entrusting the preparation, processing, reporting, and legal compliance of wage payments to an external fiduciary or payroll accounting provider. For many Swiss SMEs, this setup is a sensible alternative to hiring in-house expertise or managing payroll manually with limited resources.

By outsourcing, companies shift the administrative and legal responsibilities for payroll processing to trained professionals. This ensures compliance with complex Swiss labor and accounting laws, reduces internal costs and effort, and frees up time to focus on core business activities.

Advantages of outsourcing payroll:

- No internal training or ongoing research required

- Time savings and reduced administrative workload

- Access to professionals for legal or tax-related questions

- Correctly prepared and legally compliant payslips

- Lower risk of errors, fines, or missed deadlines

- Scalable solution as your team grows

- Efficient handling of special cases (e.g. cross-border commuters, maternity leave, bonuses)

Disadvantages of outsourcing payroll:

- Additional costs, typically billed monthly according to the number of employees

- Dependence on external availability (e.g. potential delays during holidays or illness)

- Limited internal skill building in payroll accounting

- Less flexibility for last-minute changes if not properly coordinated

While some SMEs are reluctant to outsource due to costs or fear of losing control, the long-term time savings and reduced risk almost always outweigh the drawbacks. With a strong fiduciary partner like Nexova, who combines expert support with advanced digital tools, outsourcing becomes the most efficient and legally secure way to handle the complexities of payroll.

Find out everything you need to know about our payroll accounting service.

Go to Payroll AccountingHow does software help SMEs handle their payroll accounting?

The use of payroll software can be extremely helpful for ensuring that salaries are calculated correctly, social insurance contributions are handled automatically, and all reporting obligations are met. This is especially important for SMEs with limited in-house resources.

Modern payroll systems offer a wide range of functions:

- Automated gross-to-net calculations, based on current AHV, ALV, BVG, and tax rules

- Single data entry, where employee master data only needs to be input once

- Payslip generation in digital or print-ready formats

- Reporting interfaces with compensation offices, pension funds, and tax authorities

- Automatic legal updates, depending on the software provider

- Cloud access for collaboration with fiduciaries, allowing real-time oversight

These features reduce manual work, lower the risk of calculation errors, and save valuable time. However, software is only as effective as the people who use it. Even the best tools can lead to errors if applied without a clear understanding of Swiss employment law or contribution thresholds.

That’s why combining software with the support of an experienced fiduciary partner is essential. A trusted provider ensures that the system is properly configured and that every payroll cycle meets legal and regulatory standards.

Popular payroll software solutions

Commonly used payroll solutions in Switzerland include SwissSalary, Abacus, Bexio, KLARA, and Personio. At Nexova, we use SwissSalary because of its regulatory precision, seamless integration with Microsoft Dynamics 365 Business Central, and suitability for SMEs. It enables efficient payroll handling while ensuring full compliance with Swiss employment and tax law.

For SMEs, choosing a trusted software provider and combining it with expert support can make a major difference in managing payroll confidently and correctly.

Book a free initial consultation with our experts.

Book a callYour digital trustee partner

As a trusted fiduciary partner, Nexova offers a fully managed payroll accounting service tailored to Swiss startups and SMEs. Our experts combine deep regulatory knowledge and accounting expertise with the power of SwissSalary.

We ensure that every salary, deduction, and payroll report is handled precisely, on time, and in full compliance with Swiss law. We also charge a transparent, fixed fee of CHF 27.50 per employee for our services which you can easily determine upfront using our price calculator.

With Nexova, you benefit from:

- Accurate and fully compliant monthly payroll processing

- AHV, BVG, and tax reporting handled for you

- Full management of withholding tax, family allowances, and accident insurance

- Professional document archiving and year-end salary certificates

- Access to cloud-based digital tools and expert advice whenever needed

Whether you’re a growing company hiring your first employees or a fast-moving SME scaling your team, we adapt our service to match your needs. Let our payroll team assess your current setup and show you how we can simplify your processes, reduce risks, and save time.

Talk to us today to discover how simple Swiss payroll can be with the right partner.

FAQ

Answers at a click

Can I do payroll myself as an SME?

Legally, yes, any employer or designated internal staff member can process payroll. However, because of the complex and evolving nature of Swiss labor and tax laws, many businesses choose to outsource this responsibility to a professional fiduciary or accounting partner. For SMEs in particular, the risk of errors, missed deadlines, or non-compliance can be high without dedicated HR or payroll staff.

Nexova supports SMEs by managing the entire payroll process on their behalf. We combine our extensive experience in payroll processing and Swiss labor laws with the use of market-leading software to ensure your payroll is accurate, compliant, and delivered on time. This gives you peace of mind while freeing up valuable internal time and resources.

What software is best for payroll in Switzerland?

SwissSalary is the recommended top choice for most SMEs and fiduciary providers, and is what Nexova personally uses. It’s fully compliant with Swiss regulations, runs seamlessly alongside Microsoft Dynamics 365 Business Central, and offers cloud access for real-time collaboration between you and your fiduciary partner. Other commonly used tools include Abacus, Bexio, KLARA, and Personio. The best software depends on your company size, complexity, and whether you work with a fiduciary partner.

Do I have to register every employee with AHV and BVG?

Yes. Registration with the AHV (1st pillar social insurance) is mandatory for all employees. BVG (2nd pillar pension fund) registration is also required for employees earning above the minimum threshold and meeting age requirements. Employers must ensure timely registration and deregistration to remain compliant and avoid penalties.

What does payroll accounting cost, and who bears the responsibility?

Employers are legally responsible for payroll accuracy, timely payments, and reporting. Costs vary based on the number of employees and level of complexity (e.g. cross-border workers, bonuses), as well as whether you handle it in-house or outsource it.

Nexova offers payroll processing and management at a fixed monthly fee of CHF 27.50 per employee, providing full transparency and cost predictability for SMEs. This covers all standard payroll tasks — including payslip generation, social insurance declarations, and year-end salary certificates — and reduces internal workload while ensuring full compliance with Swiss law.

Nexova takes over the entire payroll processing and administration at a fixed price of CHF 27.50 per employee per month. This gives SMEs full cost transparency and planning security. The rate covers all standard services – from payroll accounting and social insurance declarations to annual salary statements – and reduces internal costs while ensuring compliance with all legal requirements.

Trusted by over 250 companies

Discover the diversity of our customers

As an internationally active biotechnology company that stands for innovation and the highest quality, we work exclusively with partners who meet our high standards. Nexova consistently impresses us with exceptional service quality, robust processes, and an impressive pace. The professional, solution-oriented, and efficient collaboration allows us to fully focus on our core business. Additionally, we would like to highlight the remarkable cost savings of 35% compared to in-house accounting. We particularly appreciate how Nexova quickly understands, develops, and promptly implements complex requirements – both within Switzerland and at our international subsidiaries. We can wholeheartedly recommend the Nexova team.

Nexova AG offers highly professional accounting services that have significantly enhanced our financial management at Learning Lab. Their team is precise and reactive, always delivering accurate and timely reports while promptly addressing our queries. With Nexova AG’s support, we manage our clients’ accounts and finances more efficiently. We highly recommend Nexova AG for their exceptional accounting services.

For us as a new catering company, it is essential that our trustee understands our specific needs and responds flexibly to our requirements. In Nexova AG, we have found the ideal partner who supports us competently in all fiduciary matters and actively promotes our growth.

Uncomplicated or serious? Or is it and? A young, clever team is at work here, offering excellent services, highly uncomplicated and competent. Instead of a prestigious reception, expensive offices and chocolates, there are fast services and competent services. For me as a one-man company, this is exactly what I need.

Arvy AG has found an exceptional partner in Nexova AG. Their very high level of expertise in FINMA-regulated industries ensures that our financial transactions are in safe and competent hands. What sets Nexova apart is their flat-rate pricing structure, which has helped us greatly with budgeting and financial planning. As a company committed to long-term success and integrity in investments, we are very satisfied with the services provided by Nexova AG.

For us as an EdTech startup, it is very important that our trustee is as digital and agile as we are. With Nexova AG, we have found the perfect partner who can actively support us in our growth.