Tax and Legal

February 21, 2024 |

David Merz

When calculating and declaring VAT in Switzerland, not all companies have to follow the conventional effective billing method. This blog explores the net tax rate method as an alternative to the effective billing approach. We outline what the net tax rate method is, who can use it, and how it works in practice. We also examine the relative advantages and disadvantages of this approach and conclude on when it makes sense to use it.

Read more

December 26, 2023 |

David Merz

The backbone of a well-structured company is its statutes, or “articles of association”. These crucial founding documents establish the internal rules by which any company in Switzerland operates and guides its purpose. Drafting them for the first time or making a later alteration calls for the utmost care and expertise. In this blog, we provide a comprehensive explanation of what these statutes are and what information they should include. We also explore in detail what it takes to make changes to a company’s statutes after it has been incorporated.

Read more

December 24, 2023 |

David Merz

In an increasingly globalized world where “employment borders” are dissolving, more employees in Switzerland have foreign employers. There is nothing fundamentally illegal about employment arrangements like this, yet they do create additional complexities surrounding labor law and social security. In this blog, we explore these issues in depth, specifically how to deal with social security contributions for these types of employees, who are also known as ANobAG.

Read more

December 24, 2023 |

David Merz

When incorporating a new company in Switzerland or converting a sole proprietorship into an AG or GmbH, it is possible to fulfil the capital requirements with contributions in kind instead of a cash deposit. This is useful for those with existing and useful assets but limited free capital. In this article, we explore the practicalities of this process. We explain what is meant by a contribution in kind and what types of assets qualify, how to value these assets, and the requirements and costs for establishing contributions in kind when incorporating a new company.

Read more

December 23, 2023 |

David Merz

Partial taxation of dividends in Switzerland offers a welcome respite from the economic burden of double taxation. In this article, we discuss the issue of double taxation of dividends and the solution of partial taxation implemented in 2009, as well as the adjustments brought about by the STAF initiative in 2020. We provide insights into eligibility criteria, methods of partial taxation, and other key considerations. We also explain the importance of seeking expert guidance when navigating the intricacies of taxation of dividends while staying compliant.

Read more

November 7, 2023 |

David Merz

The owner of a GmbH or AG is always faced with the important question of how best to optimise the income they receive from their company. The issue primarily comes down to deciding on the balance between salary and dividends. This is a pivotal decision with implications for personal income, social security, and tax efficiency. In this article, we explore the considerations and consequences involved in this choice, and what is practically permissible in the efforts to optimise taxes.

Read more

November 6, 2023 |

David Merz

Switzerland offers a prosperous corporate landscape and is home to many thriving businesses; however, not all companies stand the test of time. If you find that your business is no longer working out, you may have to make the difficult decision to liquidate and dissolve it. In this article, we explore the liquidation process in Switzerland, including its possible reasons, effects, and the specific steps involved in liquidating different types of companies.

Read more

September 17, 2023 |

David Merz

Since 1 January 2020, the tax privilege for Swiss holding companies has ceased to apply. The following blog explains how this came about, when we speak of a holding company at all and the range of advantages and disadvantages that holding companies continue to offer.

Read more

August 12, 2023 |

David Merz

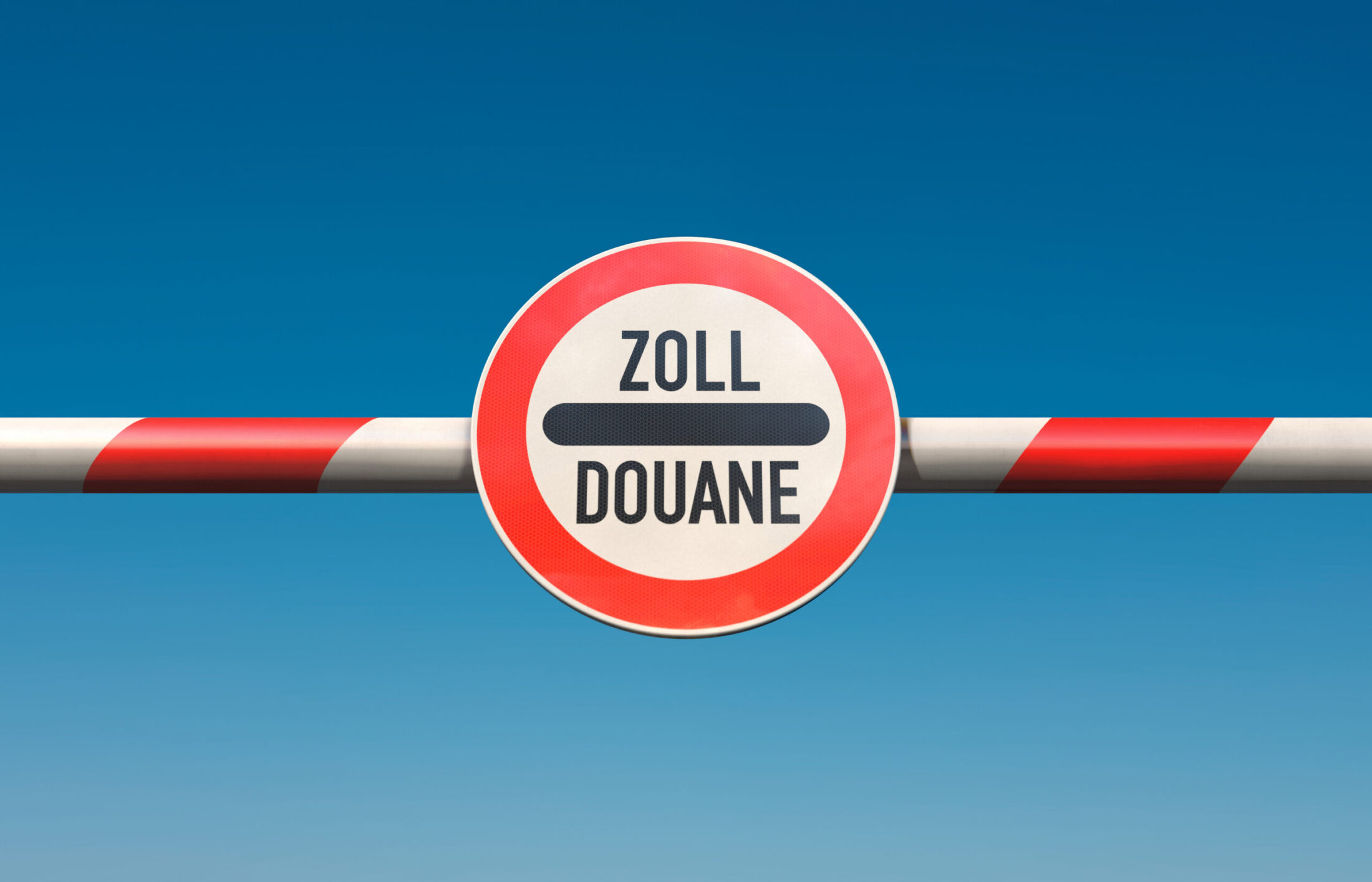

The increasing trend towards cross-border online trade provides many opportunities for businesses to access new consumer markets from around the globe. The Swiss market has become particularly attractive for online shops based in the EU. It is essential for these businesses to understand the customs and tax obligations when shipping their goods to Switzerland. In this article, we provide key insights into Switzerland's customs and tax laws, including customs clearance procedures, VAT regulations, exemptions, and issues surrounding VAT registration in Switzerland.

Read more